How Much Business Insurance Do You Really Need?

Starting and running a business involves navigating a landscape filled with opportunities and risks. One of the most crucial steps in safeguarding your venture is understanding the importance of business insurance. But how much insurance is truly necessary? This comprehensive guide delves into the factors influencing your insurance needs, the types of coverage available, and how to determine the right amount for your business.

Key Takeaways

- Assess Your Risks: Understand the specific risks associated with your industry and operations to determine necessary coverage.

- Understand Legal Requirements: Ensure compliance with local laws regarding mandatory insurance types.

- Regularly Review Coverage: Periodically evaluate your insurance policies to accommodate changes in your business Insurance.

- Consult Professionals: Work with insurance brokers or advisors to tailor coverage to your business’s needs.

- Maintain Proper Documentation: Keep detailed records of your insurance policies and any claims to streamline the process if needed.

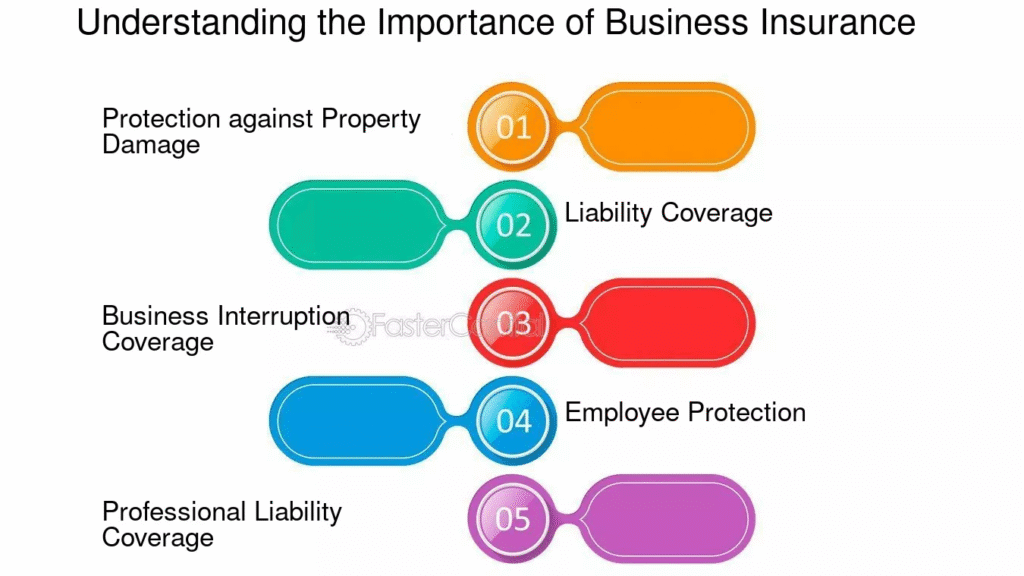

Understanding the Importance of Business Insurance

Business insurance serves as a safety net, protecting your company from financial losses due to unforeseen events such as accidents, lawsuits, or natural disasters. Without adequate coverage, a single incident could jeopardize your business’s survival. Insurance not only mitigates risks but also provides peace of mind, allowing you to focus on growth and innovation.

Protection Against Financial Loss

At its core, business insurance is about protecting your company from financial losses that could arise from:

- Property damage (fires, floods, vandalism)

- Lawsuits (from customers, vendors, or employees)

- Accidents and injuries

- Equipment breakdowns

- Data breaches or cyberattacks

Without insurance, your business would have to cover these losses out of pocket — which can be devastating, especially for small or growing business Insurance.

Example:

A fire in a bakery could destroy inventory, ovens, and the storefront. Without property and business Insuranceinterruption insurance, the owner might face over $200,000 in losses, not counting lost income during closure.

Legal and Regulatory Compliance

In many jurisdictions, certain types of insurance are mandatory by law. Common examples include:

- Workers’ Compensation Insurance: Required in most states if you have employees.

- Commercial Auto Insurance: Needed if you use vehicles for business Insurance purposes.

- General Liability Insurance: Often required by landlords or contractors before leasing or starting work.

Operating without required insurance can lead to fines, penalties, or even business Insurance closure.

Example:

A business Insurance in California without proper workers’ comp could face fines up to $100,000 and criminal charges for noncompliance.

Client and Contractual Requirements

Many clients, especially large corporations and government agencies, will not work with uninsured businesses. They often require proof of:

- General Liability Insurance

- Professional Liability Insurance

- Errors & Omissions Coverage

- Product Liability Coverage (for manufacturers)

Having insurance opens doors to larger contracts and partnerships by proving your business is credible, stable, and responsible.

Example:

An IT contractor bidding on a government project may be required to show $2M in E&O coverage before being considered.

Peace of Mind and Risk Transfer

Business insurance helps you transfer risk to the insurer, allowing you to focus on what matters: growing your company. Instead of living in fear of what could go wrong, you can operate confidently, knowing your business Insurance is backed by coverage.

- You’re protected if someone slips and falls in your store.

- You’re covered if a disgruntled client sues you for negligence.

- Your data breach doesn’t bankrupt you.

Peace of mind isn’t just emotional — it’s strategic. It lets you make bolder decisions with less anxiety about potential consequences.

Protecting Employees and Enhancing Retention

Employees are among your most valuable assets. Offering insurance like:

- Workers’ Compensation

- Health and Life Insurance

- Disability Insurance

… shows that you care about their well-being, boosting morale, loyalty, and retention. It also reduces your liability in the event of workplace accidents.

Example:

If an employee gets injured operating machinery, workers’ comp pays for medical care and lost wages — avoiding a costly lawsuit.

Supports Business Continuity

In a disaster scenario, business insurance can be the difference between temporary closure and permanent shutdown.

Business Interruption Insurance:

- Covers lost revenue while you rebuild after a fire, flood, or similar event.

- Pays ongoing costs like rent, utilities, and payroll during downtime.

Without this, even a short closure can permanently disrupt your cash flow.

Factors Influencing Your Insurance Needs

Determining the appropriate amount of insurance for your business depends on several key factors:

- Industry Type: Different industries face varying levels of risk. For instance, a construction company may require more extensive coverage than a consulting firm due to the physical nature of its operations.

- Business Size: Larger businesses with more employees and assets typically need higher coverage limits to protect against potential claims.

- Location: The geographical location of your business Insurance can impact your insurance needs. Areas prone to natural disasters may necessitate additional coverage.

- Legal Requirements: Some regions mandate certain types of insurance, such as workers’ compensation or liability insurance, depending on your business’s structure and location.

- Client Contracts: Clients may require specific insurance coverage before entering into agreements, especially in industries like construction or healthcare.

Essential Types of Business Insurance

While the specific needs vary, most business Insurance should consider the following types of insurance:

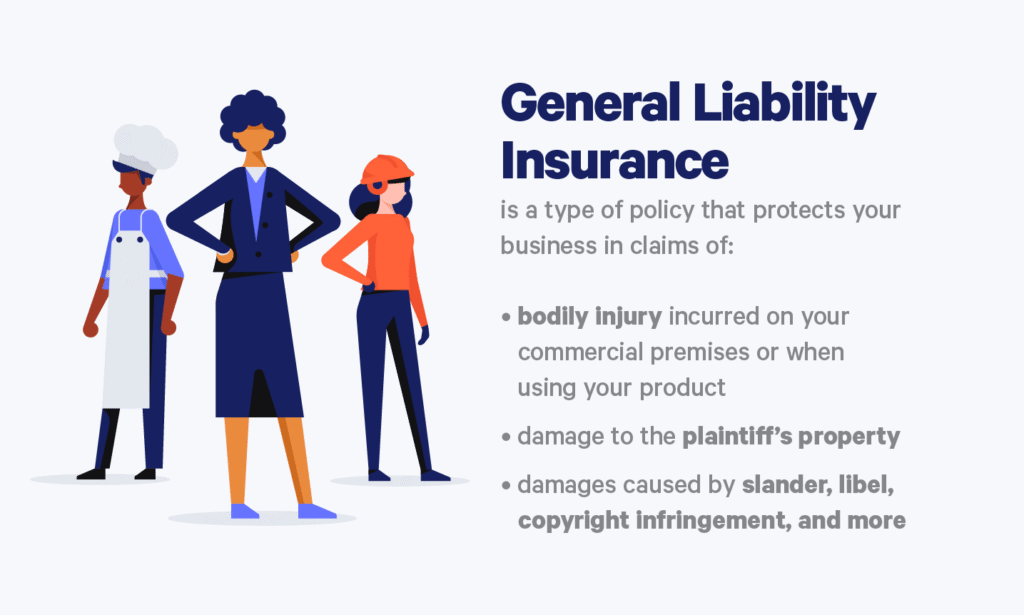

General Liability Insurance

This foundational policy protects against third-party claims of bodily injury, property damage, and advertising injury. It’s essential for business Insurance that interact with clients or the public.

Professional Liability Insurance

Also known as errors and omissions (E&O) insurance, this covers legal costs arising from claims of negligence or subpar services. It’s crucial for service-based businesses and professionals.

Property Insurance

This covers damage to your business Insurance property, including buildings, equipment, and inventory, due to events like fire, theft, or vandalism.

Workers’ Compensation Insurance

Mandatory in many regions, this insurance provides medical benefits and wage replacement to employees injured on the job.

Business Interruption Insurance

This policy compensates for lost income if your business Insurance operations are halted due to a covered event, helping you maintain financial stability during recovery.

Cyber Liability Insurance

With the increasing threat of cyberattacks, this coverage protects against data breaches, hacking, and other cyber threats that could compromise sensitive information.

Determining the Right Coverage Amount

Choosing the correct coverage limit is not just about protecting against possible losses—it’s about understanding how much financial risk your business Insurance can realistically bear and what the consequences would be without insurance. Let’s dive into each policy type and explore how to make informed coverage decisions.

General Liability Insurance

What It Covers:

- Third-party bodily injury

- Property damage

- Personal and advertising injury (e.g., defamation, copyright infringement)

Coverage Range:

- Typical limits: $500,000 to $2 million per occurrence, and $1M–$4M aggregate annually.

How to Determine Your Limit:

- Low-risk industries (e.g., consultants, designers): $500,000–$1M may be sufficient.

- Moderate-risk industries (e.g., retailers, restaurants): At least $1M–$2M.

- High-risk industries (e.g., construction, manufacturing): $2M+ coverage is recommended.

Example:

A customer slips and falls in your store, requiring surgery and rehabilitation. The medical and legal costs could easily exceed $500,000—without sufficient liability coverage, you’d pay out of pocket.

Professional Liability Insurance (Errors & Omissions Insurance)

What It Covers:

- Negligence

- Misrepresentation

- Breach of professional duty

- Inaccurate advice or service failure

Coverage Range:

- Typical limits: $250,000 to $2 million per claim, $1M to $3M aggregate annually.

How to Determine Your Limit:

- Freelancers/solo consultants: $250,000–$500,000 may suffice.

- Small to mid-sized firms: $1M is a common starting point.

- Highly regulated fields (finance, legal, healthcare): $2M+ is often necessary.

Example:

A marketing consultant is sued by a client for a failed campaign that led to $100,000 in lost revenue. A $250,000–$500,000 E&O policy could cover the defense and settlement costs.

Property Insurance

What It Covers:

- Physical damage to your building, equipment, inventory, or furnishings from fire, storms, theft, vandalism, etc

How to Determine Coverage:

- Your coverage should match the replacement cost of your assets (not just current market value).

- Include:

- Real estate value (if owned)

- Fixtures and fittings

- Equipment and machinery

- Computers and electronics

- Inventory and raw materials

Tip:

Request a property appraisal to accurately determine the value of what needs to be insured

Example:

If your business Insurance owns $750,000 worth of equipment and inventory, and a fire destroys it all, you’ll need that full amount to replace everything and resume operations.

Workers’ Compensation Insurance

What It Covers:

- Medical expenses and lost wages for employees injured on the job

- Disability benefits

- Legal costs if the employee sues

How to Calculate:

- Rates are determined by:

- State laws (mandatory in most states)

- Job classification codes: Riskier roles have higher premiums (e.g., roofing vs. office admin)

- Total annual payroll

General Cost Rule:

- Rates can range from $0.75 to $3 per $100 in payroll, depending on your industry.

Example:

A warehouse with $500,000 in payroll might pay $7,500–$15,000/year in Workers’ Comp, depending on the risk category.

Business Interruption Insurance

What It Covers:

- Lost income and ongoing expenses during a business Insurance shutdown due to a covered peril (e.g., fire, flood)

How to Determine Coverage:

- Look at your average monthly gross income

- Add ongoing fixed expenses, such as:

- Rent/mortgage

- Employee salaries

- Loan payments

- Utilities

- Multiply by the expected duration of the shutdown (30, 60, 90 days, etc.)

Calculation Example:

If your monthly revenue is $60,000 and you’d need 3 months to reopen after a fire:

- $60,000 × 3 months = $180,000 minimum coverage needed

Cyber Liability Insurance

What It Covers:

- Data breach response (notification, credit monitoring)

- Ransomware attacks

- Legal defense and settlements

- IT forensics and system restoration

Coverage Range:

- $250,000 to $5 million or more

- SMBs typically opt for $1M in coverag

Factors to Consider:

- Volume of sensitive customer data stored

- Regulatory exposure (e.g., HIPAA, GDPR)

- Type of data stored (financial, health, personal identification)

Example:

If you store personal data of 10,000 customers, and a breach occurs, your costs might include:

- Notification: $1–$2 per record

- Credit monitoring: $5–$10 per person

- Legal and IT forensics: $100,000+

Total breach response can easily exceed $500,000, making $1M coverage a safe baseline.

Annual Insurance Review and Adjustment Strategy

Your business is not static — and your insurance coverage shouldn’t be either. Here’s a structured process to help ensure your coverage evolves with your company:

When to Review Your Coverage:

- Annually as a rule of thumb.

- After significant events, such as:

- Hiring new employees

- Entering new markets or states

- Launching a new product or service

- Moving to a new location

- Taking out a loan or gaining investors

How to Review:

- Compare current policy limits with actual asset growth and risk exposure.

- Review recent claims or near-misses — these can indicate new vulnerabilities.

- Benchmark against competitors or industry standards — are similar businesses carrying higher limits?

Insurance-to-Value (ITV) Ratio

A critical concept in commercial property insurance is Insurance-to-Value (ITV) — it ensures you’re not underinsured.

- ITV = (Amount of Insurance) / (Full Replacement Cost)

- If your ITV is below 80% or 90%, many insurers will reduce payouts proportionally — known as the co-insurance penalty.

Example:

Your property’s replacement cost is $1,000,000. If you insure it for only $700,000 and experience a $400,000 loss:

- Your payout might be:

($700,000 ÷ $1,000,000) × $400,000 = $280,000, not the full loss.

Policy Endorsements and Riders

Endorsements or riders are custom add-ons to standard policies that expand or clarify coverage. They’re vital when your business has special risks or assets.

Common Riders Include:

- Equipment Breakdown Coverage – For machinery or manufacturing tools.

- Off-premises Coverage – For mobile businesses or pop-up shops.

- Inland Marine Insurance – For tools, equipment, or products in transit.

- Flood or Earthquake Endorsements – Typically excluded from base property policies.

These can fill coverage gaps without needing a separate policy.

Self-Insurance and Retention Options

For more established or cash-rich businesses, self-insurance or high-deductible plans can be cost-effective.

When to Consider:

- If you have strong cash reserves

- If claims history is minimal

- If you want to reduce premium costs

Caveats:

- You assume higher financial risk upfront.

- You may need to meet minimum state coverage requirements despite self-insuring (especially for Workers’ Comp).

Best used by large firms with mature risk management strategies.

Business Insurance Scenario Modeling

One of the most accurate ways to determine how much insurance you need is to run “what-if” scenarios:

| Scenario | Policy Type | Cost Without Insurance | Cost With Insurance |

|---|---|---|---|

| Data breach of 20,000 records | Cyber | $800,000+ | $10,000 deductible, rest covered |

| Lawsuit from injured customer | General Liability | $1.5M legal and medical | Covered up to $2M |

| Fire destroys equipment | Property | $500,000 | Full replacement covered |

This method shows you how your business would fare under a crisis and helps guide smarter decisions about coverage limits.

Understanding Aggregate vs. Per-Occurrence Limits

Most policies have two key limits:

- Per Occurrence Limit: Max amount paid for a single claim/event.

- Aggregate Limit: Max total the insurer will pay in a policy term (usually annual).

Example:

- General Liability policy: $1M per occurrence / $2M aggregate

- You have two large claims:

- Claim 1: $800,000

- Claim 2: $1.2M

You’re covered for both because the total ($2M) is within the aggregate limit.

But if Claim 2 had been $1.5M, you’d exceed your total limit and be responsible for $300,000 out-of-pocket.

These figures help assess whether you’re over- or under-insured relative to peers.

When to Increase Coverage

Increase your insurance limits if:

- You’ve secured major funding or investment

- You’ve signed a large client contract

- You’re offering higher-risk services

- You’ve moved to a larger or more expensive location

- You’ve recently faced or narrowly avoided a large claim

Would you like a custom insurance coverage checklist, risk matrix, or interactive calculator to go with this guide? I can generate that for you. Let me know how you’d like to format or use this content — as a report, PDF, blog series, or internal training resource.

You said:

Final Tips for Estimating Insurance Coverage Needs

- Start with Baselines: Use industry averages and consult trade associations.

- Understand Your Contracts: Vendors or clients may require specific minimums.

- Consult Professionals: An insurance broker can help you determine appropriate limits and tailor policies to your risk profile.

- Review Annually: Reassess your insurance needs every year or after a major change in your business (e.g., expansion, new product, hiring spree).

Cost Considerations

The cost of business insurance varies based on several factors, including:

- Industry Risk Level: High-risk industries may face higher premiums.

- Coverage Limits: Higher coverage limits generally result in higher premiums.

- Deductibles: Opting for higher deductibles can lower premium costs but increases out-of-pocket expenses in the event of a claim.

- Claims History: A history of frequent claims can lead to higher premiums.

- Business Location: Areas prone to natural disasters or with higher legal costs may have higher premiums.

Also Read: Do You Really Need Home Insurance?

Conclusion

Determining the right amount of business insurance is a critical step in protecting your company’s assets, employees, and future. By assessing your business’s unique risks and needs, you can select appropriate coverage that provides comprehensive protection without unnecessary costs. Regularly reviewing and adjusting your insurance as your business evolves ensures continued security and peace of mind.

FAQs

1. Is business insurance mandatory?

In many regions, certain types of insurance, such as workers’ compensation and liability insurance, are legally required for businesses with employees.

2. Can I bundle insurance policies to save costs?

Yes, many insurers offer package policies that combine multiple coverages at a discounted rate.

3. How often should I review my insurance coverage?

It’s advisable to review your insurance annually or whenever significant changes occur in your business operations.

4. What happens if I don’t have the required insurance?

Operating without required insurance can lead to legal penalties, fines, and potential lawsuits.

5. Can I adjust my coverage as my business grows?

Yes, insurance policies can be adjusted to accommodate changes in your business size, revenue, or operations.

6. Are there discounts available for business insurance?

Many insurers offer discounts for factors like bundling policies, having a good claims history, or implementing safety measures.

7. How do I choose the right insurance provider?

Consider factors such as the insurer’s reputation, customer service, financial stability, and the specific coverages they offer.