What Is an Insurance Premium and How Does It Work?

In the world of personal finance and risk management, insurance is a critical tool that provides individuals, families, and businesses with financial protection against unpredictable events. At the heart of every insurance policy lies the concept of the insurance premium. Understanding what an insurance premium is, how it works, and the factors that influence its cost is crucial for making informed choices about your coverage. This guide will take you through the concept of insurance premiums, explain how they work, and answer frequently asked questions about them.

Key Takeaways

- Insurance premiums are the cost of purchasing insurance coverage and are influenced by factors like age, health, type of coverage, and risk factors.

- Premiums may be paid as fixed, flexible, single, regular, or limited premiums depending on the policy structure.

- Timely payment of premiums is crucial to maintain active coverage and avoid policy lapses.

- You can reduce your insurance premiums by increasing your deductible, bundling policies, and taking advantage of available discounts.

What Is an Insurance Premium?

An insurance premium is the amount of money an individual or entity pays to an insurance company in exchange for coverage. In simpler terms, it’s the cost of buying an insurance policy. The premium ensures that, in the event of a covered loss, the insurance company will provide financial assistance to the policyholder or their beneficiaries.

These premiums can be paid in various frequencies such as monthly, quarterly, semi-annually, or annually, depending on the policy and the preferences of the policyholder. Paying the premium regularly ensures that the insurance policy remains active and provides the necessary coverage for unforeseen events.

How Does an Insurance Premium Work?

When you purchase an insurance policy, you enter into a contract with an insurance company. In this contract, you agree to pay the insurance premium in exchange for financial protection against certain risks, such as health problems, property damage, or death.

In return, the insurer assumes responsibility for covering the specified risks or losses. The insurer calculates your premium based on a variety of factors, including your risk profile. This involves analyzing the likelihood of you making a claim during the policy term and how much it will cost the insurer to pay out any claims.

Premiums work as a form of shared risk: many policyholders contribute to the insurer’s pool of funds, which is then used to pay for the claims of those who experience losses. This helps spread the financial burden across a large group of people, making it more affordable for individuals to obtain coverage.

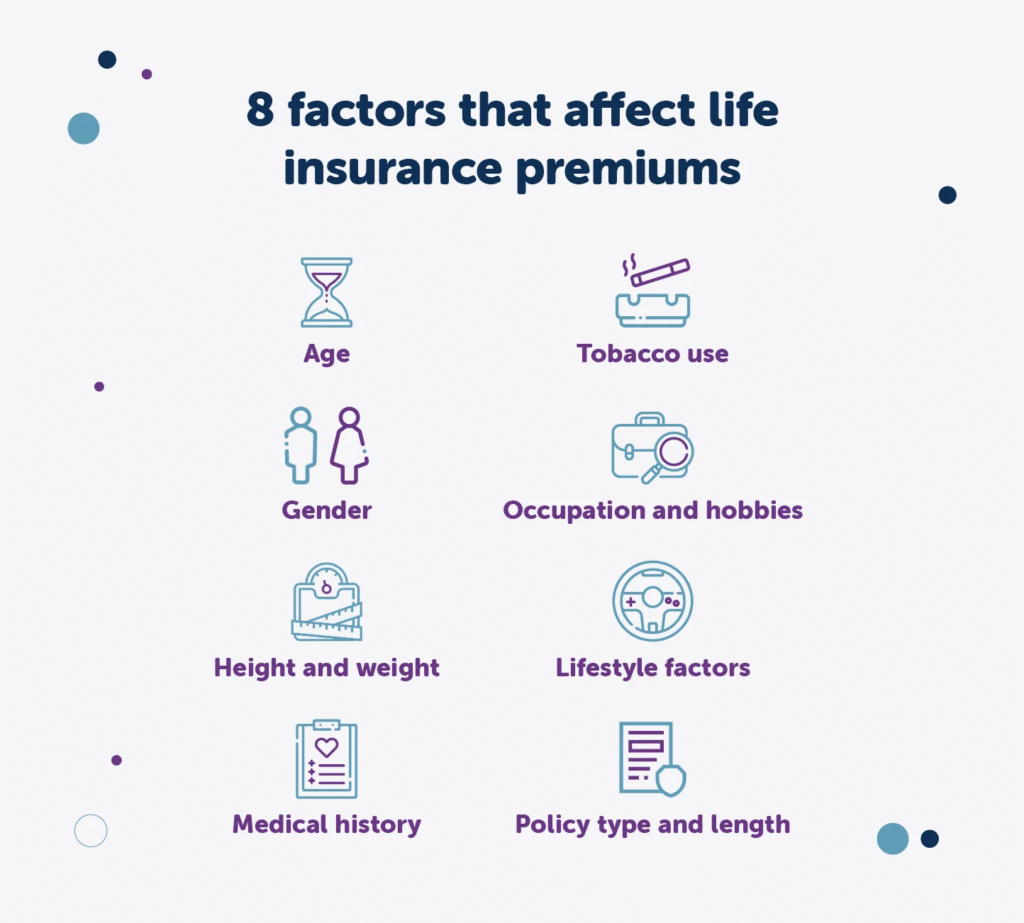

Factors That Influence Insurance Premiums

The calculation of insurance premiums is influenced by several key factors that help insurers assess the risk associated with the policyholder. These include:

Type of Insurance

- Different types of insurance policies—life insurance, health insurance, auto insurance, homeowners insurance, etc.—have different risk profiles and cost structures. For example, health insurance premiums may vary significantly from auto insurance premiums because the level of risk, frequency of claims, and potential costs involved differ.

Coverage Amount

- The higher the coverage limit or the sum insured, the higher the premium. A larger payout to policyholders means the insurance company will need to charge higher premiums to cover the potential costs.

Age

- Age plays a significant role in determining insurance premiums. Younger individuals typically pay lower premiums for life and health insurance due to lower health risks, whereas older individuals may face higher premiums as they are considered to be at a higher risk of illness or death.

Health and Medical History

- For health and life insurance policies, an individual’s health history is an important factor in premium calculation. People with pre-existing medical conditions, such as diabetes or heart disease, are typically considered higher risk, leading to higher premiums.

Occupation

- The nature of your occupation can affect your insurance premiums. Risky jobs, such as those in construction, mining, or aviation, are more likely to lead to accidents or injuries, which increases the likelihood of claims. As a result, premiums for individuals in hazardous occupations are typically higher

Lifestyle Choices

- Certain lifestyle choices—such as smoking, heavy drinking, or engaging in dangerous hobbies (e.g., skydiving or extreme sports)—can increase the risk of health issues or accidents, leading to higher premiums for life and health insurance policies.

Claims History

- If a policyholder has a history of making frequent claims, this indicates a higher risk for the insurer. As a result, insurers may increase the premium rates for such individuals in future policy renewals.

Location

- Where you live can influence your insurance premiums. For example, living in an area prone to natural disasters (such as hurricanes, floods, or earthquakes) may lead to higher premiums for homeowners insurance. Similarly, living in a neighborhood with high crime rates can affect auto insurance premiums due to the increased risk of theft or vandalism.

Credit Score

- In some regions, insurers use credit scores as an indicator of an individual’s financial responsibility. A lower credit score can suggest a higher risk of non-payment or claims, leading to higher premiums.

How Are Insurance Premiums Calculated?

Insurance companies use complex mathematical models and data analytics to calculate premiums. Actuaries, professionals who specialize in risk assessment, analyze large datasets to determine how likely a certain event is to occur and estimate the costs involved. These calculations take into account:

- Risk Assessment: This involves examining the individual’s characteristics and history to determine their level of risk. Higher risk leads to higher premiums.

- Insurance Pooling: Premiums are based on the pooling of funds from many policyholders, allowing insurers to cover the claims of those who suffer a loss while making a profit.

- Administrative Costs: The insurer’s operational expenses, including marketing, policy administration, and claims processing, are factored into the premium.

- Profit Margin: Insurers aim to make a profit, so premiums will reflect the company’s desire to cover potential claims and generate revenue.

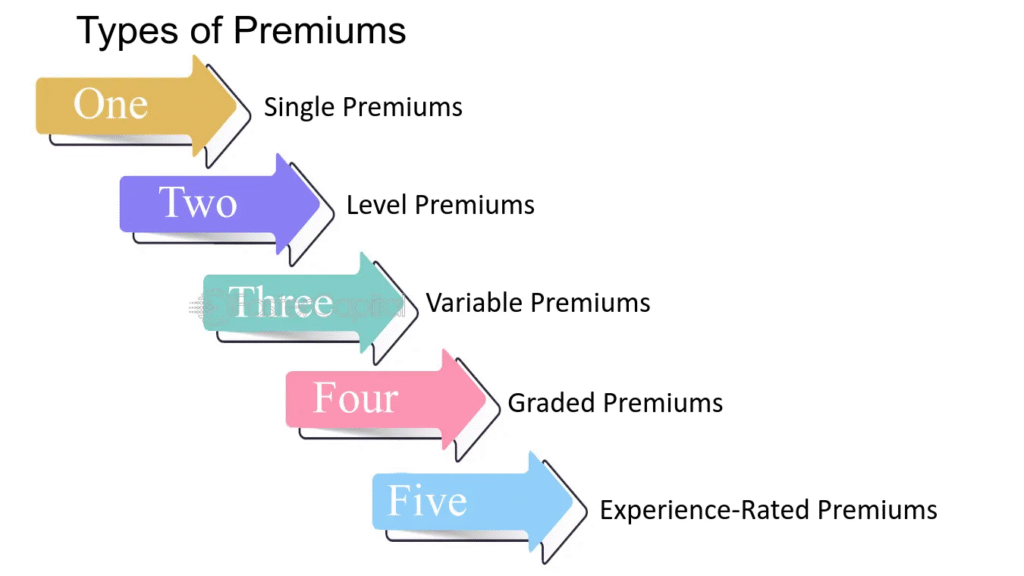

Types of Insurance Premiums

- Fixed Premium

- A fixed premium remains constant throughout the life of the policy. It does not change, even if the policyholder’s circumstances change. Fixed premiums offer predictability and are often preferred for long-term insurance like life insurance.

- Flexible Premium

- Flexible premiums allow policyholders to adjust the amount of the premium over time. This flexibility can be helpful if you experience changes in income or financial circumstances.

- Single Premium

- A single premium involves a one-time payment that covers the entire duration of the insurance policy. This option is typically seen in life insurance policies where the policyholder makes a lump sum payment upfront.

- Regular Premium

- Regular premiums are paid at regular intervals, such as monthly or annually. This is the most common premium structure for most types of insurance, including auto and health insurance.

- Limited Premium

- In this structure, the policyholder makes premium payments for a limited number of years, but the coverage continues for a much longer period. This is common in life insurance policies.

Importance of Paying Insurance Premiums on Time

Timely payment of insurance premiums is crucial to maintaining an active insurance policy. If premiums are not paid on time, the policy may lapse, meaning the insurance coverage becomes void. This can leave you without financial protection during a claim.

In some cases, insurers offer a grace period for premium payments, which is usually 30 days. If the premium is not paid during this time, the policyholder may have to pay penalties or even face difficulties in reinstating the policy.

The Importance of Insurance Premiums in Financial Planning

Insurance premiums are not just a fee to be paid; they are an essential part of long-term financial planning. Properly managing your premiums can help you balance risk and cost, ensuring that you and your loved ones have sufficient protection while avoiding financial strain. Below are some considerations for integrating insurance premiums into your financial plan:

Budgeting for Insurance Premiums

Incorporating your insurance premiums into your regular budget ensures that you can maintain coverage without disrupting your finances. Premiums are often recurring expenses, so it’s important to treat them as a fixed cost. You may want to review your policies periodically to assess whether you’re overpaying for coverage or if your premiums can be adjusted.

A good rule of thumb is to allocate about 5-10% of your annual income for insurance premiums, depending on your risk profile and the types of coverage you need. This can help you avoid financial strain while still protecting yourself against major risks.

The Role of Insurance in Protecting Assets

Insurance is a tool for managing financial risk. Whether you own a home, a car, or have dependents relying on your income, insurance helps protect these assets in the event of a disaster or unexpected event. Your premium is the cost of maintaining this protection.

For example, homeowners insurance protects your home from fire, theft, or natural disasters, and auto insurance shields you against damage from accidents or theft. Life and health insurance ensure that you can handle medical expenses and loss of income due to illness or death. Paying these premiums means you can afford the protection necessary to safeguard your assets, including your physical well-being.

Insurance as a Financial Safety Net

Many people view insurance premiums as an investment in their future financial stability. While premiums might seem like an expense, they represent the potential to recover a larger amount in the event of a covered loss. For example, health insurance can offset the massive costs associated with medical treatments, while life insurance provides a safety net for your family in case of your unexpected passing.

In essence, by paying your premiums, you are securing the safety of your assets and the financial stability of your family in the face of life’s uncertainties.

Understanding Different Types of Insurance Premiums

Insurance premiums are not all created equal, and understanding the various types can help you make better decisions when shopping for coverage. Here is a breakdown of different premium types and how they work:

Fixed Premiums

A fixed premium remains the same throughout the entire term of the policy. This is the most common premium structure for life insurance policies. For instance, if you have a 20-year term life insurance policy, the premium you pay at the start will remain the same for the entire 20 years, regardless of changes in your health or other factors. This makes fixed premiums predictable and easy to budget for over the long term.

Fixed premiums are particularly appealing to policyholders who want to ensure their insurance cost remains stable throughout the life of the policy. However, these premiums may initially be higher than adjustable ones, but the certainty they offer can be valuable for long-term planning.

Flexible Premiums

Flexible premiums allow the policyholder to adjust their premium payments, depending on their financial situation. This type of premium is often seen in policies like universal life insurance, where the policyholder has the option to increase or decrease their premium payments or coverage amount.

One of the benefits of flexible premiums is that they provide more control to the policyholder. For example, if you face a temporary financial setback, you can lower your premium payments or even skip a payment (subject to policy terms). However, flexible premiums can also be riskier if not managed properly, as underpaying can result in a policy lapse or reduced coverage.

Single Premium

A single premium is a one-time payment made at the start of the policy, covering the entire policy term. This is typically used in life insurance policies and is especially beneficial for individuals who want to make a large upfront investment and avoid ongoing payments. For example, a single premium life insurance policy might be ideal for someone who is looking to provide a legacy for their heirs or cover estate taxes but does not want to deal with annual premiums.

While single premium policies can be convenient, they also require a substantial upfront cost. Therefore, they may not be an option for everyone, especially for those with limited liquidity.

Regular Premiums

Regular premiums are paid at consistent intervals throughout the life of the policy, such as monthly, quarterly, or annually. This is the most common type of premium, seen in policies like auto, health, and home insurance. Regular premiums allow policyholders to spread the cost of their coverage over time, making it easier to manage the financial commitment.

While regular premiums can be more affordable in the short term compared to a single premium, they may result in higher overall costs due to administrative fees and inflation over time.

Limited Premiums

Limited premiums refer to policies where the policyholder pays premiums for a specified number of years, but the coverage continues for a much longer period. This option is popular in certain life insurance policies, where the policyholder might pay premiums for 10 years but enjoy coverage for 20 years or longer.

Limited premium plans can be beneficial for individuals who want to reduce their premium burden in later years but still want ongoing coverage. However, limited premiums may result in higher premiums during the payment period, and the overall cost may be higher in the long run compared to regular premium plans.

Managing and Reducing Your Insurance Premiums

While paying your insurance premium is necessary to maintain coverage, there are strategies you can use to help manage and potentially reduce your premium costs. Below are a few tips for keeping your premiums affordable:

Increase Your Deductible

A deductible is the amount you pay out of pocket before the insurance company begins covering your expenses. Increasing your deductible can reduce your premium costs, as you are taking on more of the financial responsibility upfront. However, it’s important to ensure that you can afford to pay the higher deductible in the event of a claim.

Bundle Your Policies

Many insurers offer discounts when you bundle multiple insurance policies, such as auto and homeowners insurance, with the same company. Bundling can help you save on premiums while maintaining comprehensive coverage.

Improve Your Credit Score

In some regions, insurers use credit scores as a factor in determining premiums. Maintaining a good credit score can lower the amount you pay for coverage, especially for auto and homeowners insurance.

Review and Update Your Coverage Regularly

Your insurance needs may change over time, and it’s important to review your coverage periodically. If your life circumstances change—such as moving to a safer area, getting a new job, or driving less—you may be able to lower your premiums by adjusting your coverage.

Take Advantage of Discounts

Many insurers offer discounts for policyholders who meet certain criteria, such as being a safe driver, installing home security systems, or maintaining a healthy lifestyle. Be sure to ask your insurer about available discounts and take advantage of those that apply to you.

Also Read: How Much Business Insurance Do You Really Need?

Conclusion

Insurance premiums are a fundamental part of any insurance policy. They are the amount you pay in exchange for coverage and protection against life’s uncertainties. Whether you are purchasing life, health, auto, or home insurance, understanding how premiums work and the factors that influence their cost is essential to making informed decisions about your coverage.

Premiums can vary widely based on a range of factors, from the type of insurance to your lifestyle and claims history. By understanding these factors, you can make better decisions about the kind of coverage you need and how to manage the cost of your insurance premiums.

FAQs

1. Can my insurance premium increase over time?

Yes, insurance premiums can increase over time due to factors such as aging, claims history, policy changes, or inflation adjustments. Insurers periodically reassess risk and may adjust rates accordingly.

2. Is it possible to lower my insurance premium?

Yes, there are several ways to potentially reduce your premium, including:

- Increasing your deductible

- Bundling multiple policies (e.g., home and auto)

- Maintaining a good credit score

- Practicing safe driving habits for auto insurance

3. What happens if I miss a premium payment?

Missing a payment can lead to a lapse in coverage, which may leave you unprotected. However, many insurers offer a grace period, and some allow policy reinstatement if the missed payment is resolved promptly.

4. Are premiums tax-deductible?

In some cases, yes. For example, health insurance premiums may be tax-deductible under certain conditions. Rules vary by country, type of insurance, and policyholder status, so consult a tax professional for specifics.

5. Do all insurance companies calculate premiums the same way?

No. While most insurers consider similar risk factors—such as age, health, and claims history—they may use different formulas and underwriting criteria, which is why premiums can vary between providers.

6. Can I change my premium payment frequency?

Yes, most insurers offer flexible payment options, allowing you to choose between monthly, quarterly, semi-annual, or annual payment schedules to better fit your financial situation.

7. What is an actuary’s role in calculating premiums?

Actuaries are professionals who use statistics, probability, and financial theory to assess risk and help set insurance premiums. They analyze large data sets to estimate the likelihood of future claims and ensure the financial stability of insurance plans.