Do You Really Need Home Insurance?

Home insurance is often perceived as an optional expense, but in reality, it’s a crucial safeguard for homeowners. Whether you’re a first-time buyer or have owned your home for years, understanding the importance of home insurance can protect you from unforeseen financial burdens. This article delves into the necessity of home insurance, its benefits, and answers to frequently asked questions.

Key Takeaways

- Home insurance offers protection against natural disasters, theft, and liability.

- It provides peace of mind, knowing you’re financially safeguarded.

- Assess your property’s value and risks to determine appropriate coverage.

- Regularly review and update your policy to ensure adequate protection.

- Understand exclusions and consider additional coverage if necessary.

Understanding Home Insurance

Home insurance, also known as homeowners insurance, is a policy that provides financial protection against damage to your home or belongings within it. It typically covers:

- Dwelling Coverage: Protection against damage to the structure of your home.

- Personal Property Coverage: Covers personal belongings like furniture, electronics, and clothing.

- Liability Protection: Offers coverage if someone is injured on your property and decides to sue.

- Additional Living Expenses: Pays for living costs if your home becomes uninhabitable due to a covered event.

Why Is Home Insurance Essential?

Protection Against Natural Disasters

Natural disasters such as earthquakes, floods, and storms can cause significant damage to your property. In India, regions like Gujarat have experienced devastating earthquakes, leading to massive property losses. Home insurance can help cover the costs of repairs or rebuilding, alleviating the financial strain.

Safeguard Against Theft and Vandalism

Burglary and vandalism are unfortunate realities. Home insurance can compensate for stolen items and repair damages caused by such incidents, ensuring you’re not left financially vulnerable.

Liability Coverage

Accidents can happen. If someone is injured on your property, you could be held liable for medical expenses and legal fees. Home insurance provides liability coverage, protecting your assets and finances.

Peace of Mind

Knowing that you’re financially protected in case of unexpected events offers peace of mind. Home insurance allows you to focus on recovery rather than financial concerns.

Compliance with Legal and Financial Requirements

In some cases, mortgage lenders require homeowners to have insurance to protect their investment. Additionally, certain regions may have legal requirements for home insurance, ensuring properties are adequately protected.

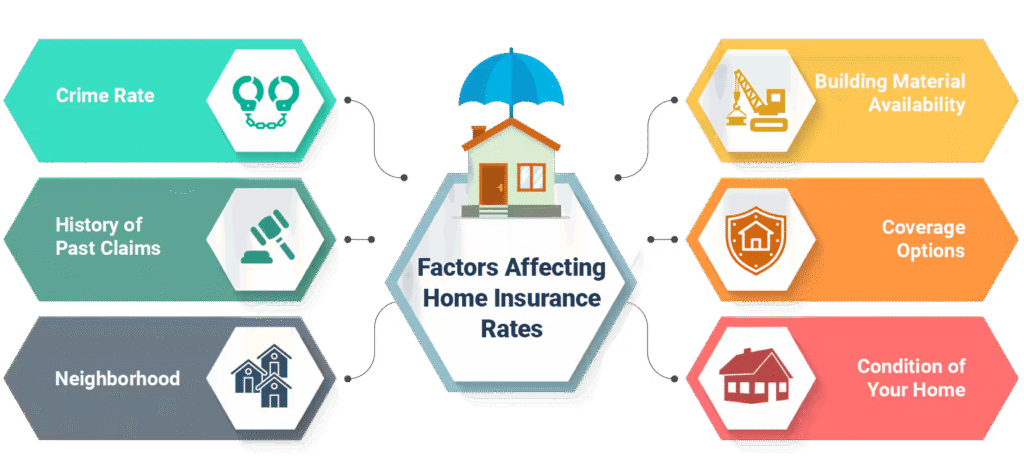

Factors Influencing the Need for Home Insurance

- Location: Areas prone to natural disasters or high crime rates may necessitate comprehensive coverage.

- Property Value: Higher-value homes may require more extensive insurance to cover potential damages.

- Personal Assets: Valuable personal belongings should be insured to protect against loss or damage.

- Legal Obligations: Mortgage agreements or local laws may mandate home insurance.

Common Misconceptions About Home Insurance

- “It’s too expensive.”

While premiums vary, the cost of not having insurance can be far greater in the event of a disaster. - “My home is safe; I don’t need insurance.”

Even in low-risk areas, unexpected events can occur. - “Home insurance covers everything.”

Policies have exclusions; it’s essential to understand what is and isn’t covered.

Types of Home Insurance Policies

Understanding the different types of home insurance policies is essential to choosing the right protection for your needs. These policies can vary based on coverage level, property type, and location.

Basic Fire and Allied Perils Policy

This is a fundamental policy that covers your home against damages caused by fire, lightning, explosion, and natural calamities like storms and floods. It is best suited for small homeowners or landlords.

Comprehensive Home Insurance Policy

Often referred to as a “package policy,” this type of insurance covers both the structure and the contents of the house. It also includes:

- Burglary or theft

- Earthquake cover (optional)

- Terrorism cover (optional)

- Personal accident cover

Structure Insurance

Covers only the building or structural part of your house. This is especially useful for landlords who rent out their property and do not need to insure the tenant’s belongings.

Contents Insurance

This type is focused on protecting your belongings inside the house—ideal for tenants. It can cover electronics, jewelry, clothing, furniture, and more.

How to Choose the Right Home Insurance Provider

Reputation and Financial Stability

Choose a provider with a strong market reputation and financial stability. You want an insurer that can honor large claims if necessary.

Claim Settlement Ratio

A high claim settlement ratio means the insurer pays out most of the claims they receive, a critical factor in assessing reliability.

Coverage Options and Customization

Look for policies that can be tailored to your specific needs. The more flexibility, the better the policy can suit your circumstances.

Premium Cost vs Coverage

Cheapest isn’t always best. Weigh the cost of the premium against the extent of coverage. Look for value rather than just savings.

Customer Service and Support

In times of crisis, you’ll need a responsive support team. Consider user reviews and ratings for service quality.

Real-Life Case Studies: The Importance of Home Insurance

Natural Disaster in Uttarakhand, India

A homeowner in a small town of Uttarakhand experienced devastating flash floods in 2021. Their comprehensive home insurance policy helped them rebuild their house and recover most of the lost valuables, preventing complete financial ruin.

Fire in an Urban Apartment

In Mumbai, a kitchen fire due to a gas leak led to significant damage in a high-rise apartment. Insurance not only covered structural repairs but also provided alternative accommodation expenses.

Theft During Vacation

A Delhi-based couple returned from vacation to find their house ransacked. Their content insurance policy reimbursed stolen electronics, jewelry, and other household goods.

Risks of Not Having Home Insurance

Choosing not to insure your home can expose you to the following risks:

- Complete financial loss due to disasters

- Expensive legal liability if someone gets injured on your property

- Uninsured rebuilding costs after fires or structural failures

- Out-of-pocket expenses for theft or vandalism

- Difficulty obtaining a mortgage without proof of insurance

Home Insurance vs. Other Types of Insurance

| Feature | Home Insurance | Life Insurance | Health Insurance | Car Insurance |

|---|---|---|---|---|

| Purpose | Protects home and assets | Financial support to family post-death | Covers medical expenses | Covers car damages and liabilities |

| Required by law? | No (except for mortgages) | No | No | Yes (in most countries) |

| Covers third-party damage? | Yes | No | No | Yes |

| Regular Claims Frequency | Low to Medium | Rare (only after death) | Frequent (illness, etc.) | Medium (accidents) |

How to File a Home Insurance Claim

Filing a claim efficiently can ensure a smoother process. Here’s a step-by-step guide:

- Inform the Insurance Provider Immediately: Most insurers have a 24/7 helpline. Call them as soon as the damage occurs.

- Document the Damage: Take clear photos and videos of the affected area.

- Provide Necessary Documents: Bills, FIR (in case of theft), policy documents, ID proof, and any repair estimates.

- Survey and Assessment: An insurance surveyor will visit to evaluate the loss.

- Claim Approval and Payout: Once verified, the claim is approved and payout is processed.

Add-On Covers You Might Need

To enhance protection, consider these riders or add-ons:

- Earthquake Coverage: Not included in standard policies.

- Flood Protection: Especially for flood-prone areas.

- Terrorism Cover: For urban homes or high-risk zones.

- Valuable Items Rider: Specific coverage for expensive jewelry, art, or electronics.

- Alternate Accommodation Cover: Pays for hotel stays if your home is uninhabitable.

Policy Exclusions: What’s Not Covered by Home Insurance?

While home insurance can offer extensive protection, it’s essential to understand that it does not cover everything. Knowing the exclusions and limitations of your policy will help you avoid surprises in the event of a claim.

Floods (in Most Standard Policies)

Many standard home insurance policies do not cover flood damage. This can be a significant issue in areas prone to heavy rains, rising water levels, or coastal flooding. If you live in a flood-prone area, you’ll need to purchase a separate flood insurance policy or add flood coverage to your existing policy.

Solution: If you live in a flood zone or near bodies of water, check whether your insurer offers flood protection as an add-on or separate policy.

Earthquakes

Like floods, earthquakes are often excluded from typical home insurance policies. Earthquake coverage, if available, is generally offered as an additional rider or separate policy.

Solution: Add earthquake insurance to your policy if you reside in an area that is seismically active. Earthquake damage can be costly, and the damage may not be fully covered without the proper rider.

Normal Wear and Tear

Home insurance generally does not cover damage caused by normal wear and tear. For example, if your roof leaks due to aging materials or your appliances break down because they’ve outlived their lifespan, these issues are typically not covered.

Solution: Regular maintenance and repairs are your responsibility. To avoid these kinds of exclusions, be proactive with upkeep to ensure your home stays in good condition.

Intentional Damage

Any damage that is intentional or caused by criminal activity such as vandalism will not be covered by home insurance policies. For example, if you intentionally set fire to your property or damage it yourself, the insurer will not pay for repairs.

Solution: Always be transparent with your insurance company about any claims, and ensure the damage was caused by a covered peril.

High-Value Items Without Special Coverage

Standard policies may have limits on high-value items like jewelry, artwork, or collectibles. If your valuable items exceed the coverage limit set by your insurer, they may not be covered unless you purchase an additional rider or endorsement.

Solution: If you own high-value items, make sure to get them appraised and insure them separately or with a specialized rider.

How Much Does Home Insurance Cost?

The cost of home insurance can vary widely based on several factors. Understanding how your premium is determined will allow you to make more informed decisions when purchasing coverage.

Location of Your Home

The location of your property plays a huge role in determining your premium. For example, homes in areas prone to natural disasters like hurricanes, earthquakes, or floods are generally more expensive to insure. Similarly, homes in high-crime areas will often cost more to insure due to the increased risk of theft or vandalism.

Age and Condition of the Home

Older homes may cost more to insure because they are often more susceptible to damage, especially if they have outdated electrical systems or plumbing. If you live in an older home, ensure that it has been properly maintained and updated to reduce the risk of costly repairs.

Coverage Limits and Deductibles

The amount of coverage you choose will directly impact your premium. Higher coverage limits (i.e., more extensive protection) will lead to higher premiums. Additionally, the deductible amount you select plays a role: a higher deductible generally lowers your premium, while a lower deductible increases it.

Claims History

Your history of making claims can also influence your premium. If you’ve made several claims in the past, insurers may consider you a higher risk, which can increase your premium. On the other hand, if you’ve been claim-free for several years, you may qualify for discounts.

Tips for Reducing Your Home Insurance Premiums

While home insurance is a necessary expense, there are several ways to reduce your premiums without compromising coverage. Here are some tips to help lower the cost:

Bundle Policies

Many insurers offer discounts if you bundle your home insurance with other types of insurance, such as auto or life insurance. Combining policies with one insurer can save you a substantial amount on premiums.

Increase Your Deductible

One of the most straightforward ways to lower your premium is to increase your deductible. The higher your deductible, the lower your monthly premium will be. However, be sure that you can afford the deductible in case of a claim.

Install Safety and Security Features

Insurance companies often offer discounts if your home has safety and security features, such as burglar alarms, smoke detectors, fire extinguishers, or a security camera system. These measures reduce the risk of loss or damage, making your home less risky to insure.

Maintain a Good Credit Score

In many regions, insurers use your credit score as a factor in determining your home insurance premium. A higher credit score often leads to lower premiums, as it indicates financial responsibility.

Shop Around and Compare Quotes

Insurance premiums can vary significantly between providers. It’s essential to shop around and get quotes from different insurance companies to ensure you’re getting the best deal for the coverage you need.

Real-Life Example: The Importance of Home Insurance

Consider the case of a young couple living in Mumbai. They bought a new home in a bustling neighborhood and opted for a basic home insurance policy. A few months later, a fire broke out in the kitchen due to an electrical fault, leading to severe damage to both the structure of the house and their personal belongings. Thankfully, they had opted for a comprehensive policy that covered both the house and their contents.

As a result, they were able to repair the damage and replace most of their lost possessions without going into debt. Had they chosen not to have home insurance, the financial burden of the fire could have been catastrophic.

Home Insurance vs. Renters Insurance vs. Landlord Insurance

Understanding the difference between types of property-related insurance is essential, especially for renters and landlords.

Homeowners Insurance

This is the most comprehensive form and is meant for individuals who own and live in their home. It covers both:

- The physical structure of the house (dwelling)

- The personal belongings inside

- Liability coverage

- Additional living expenses

Ideal for: Homeowners who occupy their home.

Renters Insurance (Tenant Insurance)

This is designed for individuals who rent their home or apartment. It doesn’t cover the structure (since that’s the landlord’s responsibility) but includes:

- Personal property coverage (furniture, electronics, clothing)

- Liability coverage

- Additional living expenses if the rented property becomes uninhabitable

Ideal for: Tenants who want to protect their belongings and liability exposure.

Landlord Insurance (Dwelling Fire Policy)

This is intended for property owners who rent out their property. It generally covers:

- Physical structure of the home

- Liability protection (if a tenant or visitor is injured)

- Loss of rental income (in case the property becomes uninhabitable)

Ideal for: Landlords who lease residential or commercial space.

Key Difference:

Homeowners insurance protects both the structure and contents when the owner lives there. Renters insurance covers only contents for tenants, and landlord insurance covers the structure (and sometimes rental income) for property owners leasing out space.

Renewing and Updating Your Home Insurance Policy

Just like any other financial product, your home insurance policy should not be a “set it and forget it” type of contract. Circumstances change, and your policy should reflect those changes to ensure adequate protection.

When to Review and Update Your Policy

- Home Renovations: If you’ve renovated your kitchen, added a new room, or made upgrades like a pool or deck, your home’s value increases, and so should your coverage.

- High-Value Purchases: Bought a new home theatre system or expensive jewelry? These should be added to your contents coverage with appropriate riders.

- Change in Occupancy: If you rent out part of your home or move out temporarily, your insurer needs to know.

- Natural Disaster Risk: Moving to a flood-prone area or seismic zone? Consider updating your policy with relevant add-ons.

Renewal Tips

- Don’t wait until the last minute. Start reviewing your policy at least a month before it expires.

- Check your no-claim bonus (NCB). If you haven’t made a claim, you may be eligible for discounts.

- Compare offers. Even if you’re happy with your current insurer, it doesn’t hurt to compare quotes.

- Update personal info. Changed contact info, marital status, or bank details? Update those during renewal.

Legal and Financial Implications of Home Insurance

Home insurance is not just a smart choice—it can also have legal and financial ramifications.

Mortgage Requirements

In most countries, mortgage lenders require borrowers to have home insurance. The lender is essentially investing in your property, and insurance protects that investment. If you cancel or lapse your policy, the lender may obtain “force-placed insurance,” which is usually more expensive and less comprehensive.

Tax Benefits

In some jurisdictions, parts of your home insurance may be tax-deductible—especially if your home is used for business or rental purposes. Consult with a tax advisor to see if you qualify.

Legal Protection

Liability protection in home insurance can shield you from expensive lawsuits if someone is injured on your property. Without it, you could be financially liable for legal fees and damages

Also Read: What Is Term Life Insurance and How Does It Work?

Conclusion

Home insurance is not just an optional expense; it’s a vital component of responsible homeownership. It provides financial protection against unforeseen events, ensuring that you and your family can recover without significant financial hardship. Assess your needs, understand your policy, and ensure you’re adequately covered.

FAQs

1. What does home insurance cover?

Home insurance typically covers damage to the home structure, personal property, liability for injuries, and additional living expenses.

2. Is home insurance mandatory?

While not always legally required, mortgage lenders often require it, and some regions have laws mandating certain types of coverage.

3. How much coverage do I need?

Coverage should be based on the replacement cost of your home and belongings, not the market value.

4. Can I customize my policy?

Yes, many insurers offer customizable policies to fit individual needs, including add-ons for specific risks.

5. Does home insurance cover natural disasters?

Standard policies may cover some disasters, but additional coverage may be needed for events like floods or earthquakes.

6. How can I lower my premium?

Increasing your deductible, bundling policies, and installing safety features can help reduce premiums.

7. What should I do if I need to file a claim?

Contact your insurer immediately, document the damage, and follow their claims process to ensure timely compensation.