How Do Business Loan Terms Affect Your Bottom Line?

Securing a business loan is a significant milestone for any entrepreneur or company aiming to expand, innovate, or stabilize operations. However, the impact of the loan extends beyond the immediate influx of capital; the terms attached to the loan can significantly influence a business’s financial health and long-term viability. Understanding how various loan terms affect your bottom line is crucial for making informed financial decisions.

Key Takeaways

- Interest rates directly affect borrowing costs and, consequently, profit margins.

- The repayment period should align with the business’s cash flow capabilities to maintain financial stability.

- Collateral requirements and associated risks must be carefully considered.

- Hidden fees and covenants can add to the overall cost and operational constraints.

- Thoroughly evaluating loan terms ensures

Understanding Business Loan Terms

Before delving into their impact, it’s essential to comprehend the key components of business loan terms:

Key Loan Terms and Their Significance

Interest Rate

- Definition: The cost of borrowing, expressed as a percentage of the loan principal.

- Types:

- Fixed: Remains constant throughout the loan term—predictable and stable.

- Variable (Floating): Fluctuates with market rates—can start lower but may increase.

Impact:

- A higher interest rate increases your total loan cost, reducing profitability.

- Even a small rate change (e.g., from 6% to 8%) on a large loan can mean thousands more in interest.

- Lower rates improve affordability, increase ROI, and preserve working capital.

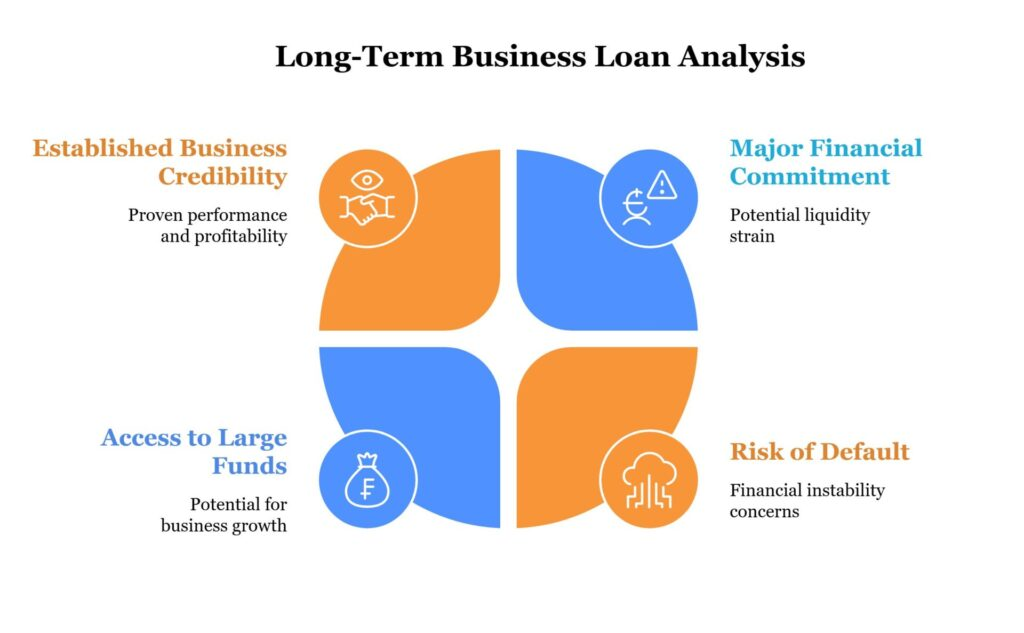

Repayment Period (Loan Tenure)

- Definition: The time you have to fully repay the loan.

- Types:

- Short-term loans: 6 months – 2 years, often with higher monthly payments.

- Long-term loans: 3 – 10+ years, with smaller installments but higher cumulative interest.

Impact:

- Shorter repayment periods mean less interest paid overall but can strain cash flow.

- Longer periods ease monthly cash flow but result in higher total repayment.

- Optimal loan tenure balances your monthly obligations with your business’s liquidity needs.

Loan Amount

- Definition: The total sum borrowed from the lender.

Impact:

- Borrowing more than needed may incur unnecessary interest costs.

- Under-borrowing can limit your ability to seize growth opportunities.

- Ensure the amount aligns with your financial projections and use case (e.g., equipment purchase vs. working capital).

Collateral Requirements

- Definition: Assets (like real estate, equipment, or inventory) pledged to secure the loan.

- Secured Loans: Require collateral.

- Unsecured Loans: Do not, but come with higher interest rates and stricter credit requirements.

Impact:

- Secured loans usually offer better terms (lower rates, larger amounts), but default could mean loss of critical assets.

- Unsecured loans reduce asset risk but cost more.

- Consider your business’s risk tolerance and asset availability when choosing.

Fees and Charges

- Common Fees:

- Origination Fee: Charged for processing the loan.

- Late Payment Penalties

- Prepayment Penalty: Charged if you pay off the loan early.

- Maintenance or Processing Fees

Impact:

- These fees can increase the effective cost of the loan, even if the interest rate seems low.

- Always compare the Annual Percentage Rate (APR), which includes both interest and fees, for an accurate comparison.

Loan Covenants

- Definition: Terms and conditions imposed by the lender that must be maintained during the life of the loan.

- Examples:

- Maintaining a minimum debt-to-equity ratio

- Restrictions on additional borrowing

- Limits on dividend distribution

Impact:

- Can restrict operational decisions, such as expanding, taking on new debt, or adjusting financial strategies.

- Violating covenants can result in penalties, higher interest, or loan recall.

- Review covenants carefully to ensure they don’t hamper business Loan agility.

Impact of Loan Terms on Your Business’s Bottom Line

Interest Rates & Profit Margins

- Directly affect the cost of capital.

- Lower interest = higher retained earnings and operational flexibility.

- High interest = squeezed margins and reduced net income.

Repayment Period & Cash Flow

- Long terms reduce payment burden, preserving cash flow.

- Short terms minimize interest but require strong cash reserves.

Collateral & Risk

- Securing loans with critical business Loan assets increases risk exposure.

- Defaulting can lead to asset seizure and operational disruption.

Fees & Charges

- Hidden costs can dramatically increase your loan’s true price.

- Always request a breakdown of all fees upfront.

Covenants & Flexibility

- Can limit financial decisions, such as hiring, investments, or expansion.

- Crucial for growth-stage or scaling businesses to maintain operational leeway.

Case Studies

- Small Retail Business

A small retail business Loan secured a short-term loan with a high-interest rate to manage seasonal inventory. While the loan facilitated timely stock procurement, the high-interest payments strained cash flow, affecting the business’s ability to invest in marketing and expansion.

- Tech Startup

A tech startup opted for a long-term loan with a lower interest rate and no collateral requirements. The favorable loan terms allowed the company to invest in research and development, leading to innovative product offerings and increased market share.

Strategic Implications of Loan Terms on Business Loan Operations

- Budget Forecasting and Financial Planning Choosing the right loan terms helps improve the accuracy of your business’s financial projections. A predictable repayment schedule with clear interest costs enables better forecasting of:

- Monthly cash outflows

- Budget allocations

- Debt-to-income ratios

- Break-even analysis

- Impact on Investment Decisions Businesses often seek loans to invest in growth—new locations, equipment, marketing campaigns, etc. The terms of a loan directly affect ROI by determining:

- When capital is available

- How quickly debt must be serviced

- How much interest accumulates

- Long-Term Debt Sustainability Sustainable borrowing hinges on maintaining healthy debt service coverage ratios (DSCR). A loan with unfavorable terms can push DSCR below acceptable thresholds, leading to:

- Breach of loan covenants

- Limited access to future funding

- Increased risk of default

Industry-Specific Considerations

Loan term suitability varies across industries. Here’s how:

- Retail & E-commerce: Often face seasonal peaks; need flexible repayment structures or working capital loans with renewable lines of credit.

- Manufacturing: Large capital needs may require equipment financing or long-term loans with asset-based lending.

- Startups & Tech Firms: Typically high-risk, may benefit from venture debt or convertible loans with equity components instead of collateral-heavy terms.

- Construction & Real Estate: Commonly use balloon loans, bridge financing, and phased drawdowns for project-based financing.

Legal and Tax Implications

- Loan Terms and Tax Deductions

- Interest payments on business loans are usually tax-deductible, but fees like loan origination charges may not be.

- Short-term vs. long-term classification can affect when and how much you can deduct.

- Compliance and Legal Obligations

- Breaking covenants or defaulting on terms can result in legal actions, asset seizure, or forced restructuring.

- Understanding local lending laws is essential, especially if operating in multiple states or countries.

Tips for Managing Business Loans Effectively

- Compare Offers from Multiple Lenders

- Use comparison tools to evaluate interest rates, fees, and customer service quality.

- Understand the APR (Annual Percentage Rate)

- APR gives a full picture of the cost of borrowing, including fees.

- Automate Payments to Avoid Penalties

- Late fees and default interest rates can quickly compound.

- Keep Your Financial Statements Updated

- Good documentation strengthens your position in negotiations and refinancing.

- Maintain a Strong Credit Profile

- A better credit score opens up access to lower rates and more favorable terms.

Choosing the Right Business Loan: A Step-by-Step Guide

Finding a loan that fits your business Loan needs starts with asking the right questions and performing due diligence. Here’s a comprehensive process to follow:

Define Your Objective

Before applying for a loan, clearly outline why you need the funds. Common purposes include:

- Purchasing inventory or equipment

- Expanding business Loan operations

- Managing seasonal cash flow

- Hiring staff or contractors

- Covering emergency expenses

Each purpose may be better suited to a specific loan type and term structure.

Evaluate Your Financial Health

Lenders assess your financial risk. So should you. Analyze:

- Credit Score (both business Loan and personal)

- Cash Flow Statements

- Profit and Loss (P&L) Statements

- Balance Sheet

- Debt-to-Income (DTI) and Debt Service Coverage Ratio (DSCR)

Understanding these metrics helps you anticipate how much you can afford to borrow—and repay.

Compare Loan Types

Here are common types of business loans and how their terms differ:

| Loan Type | Typical Use | Term | Rate | Collateral Required |

|---|---|---|---|---|

| Term Loan | General business needs | 1–10 years | 6%–20% | Sometimes |

| SBA Loan | Long-term investments | 5–25 years | 4%–10% | Usually |

| Line of Credit | Working capital | Revolving | 7%–25% | Not always |

| Equipment Financing | Asset purchase | Up to 10 years | 5%–15% | Yes (equipment itself) |

| Merchant Cash Advance | Emergency liquidity | Short-term | 20%–50% APR | No |

| Invoice Financing | Cash flow gap | Short-term | 10%–25% | Invoices as collateral |

Read the Fine Print

Don’t just focus on the interest rate. Watch for:

- Origination Fees

- Maintenance Fees

- Prepayment Penalties

- Variable Rates

- Covenants (financial performance conditions)

- Balloon Payments

If you’re unsure about a clause, consult a financial advisor or attorney.

Simulate Different Loan Scenarios

Use a loan calculator to project how changes in terms affect:

- Monthly payments

- Total interest paid

- Cash flow impact

- Loan affordability

Scenario testing helps you avoid surprises.

Debt Restructuring Adjusting Loan Terms When Needed

Businesses facing financial hardship may need to renegotiate their loan terms. Here’s how restructuring works:

When to Consider Loan Restructuring

- You’re struggling to make payments

- Interest rates have dropped significantly

- Your revenue has become more volatile

- You need to consolidate multiple loans

Common Restructuring Options

- Refinancing: Replace your loan with a new one with better terms.

- Loan Modification: Change interest rate, repayment period, or payment schedule with current lender.

- Debt Consolidation: Merge multiple loans into one with a single payment.

- Forbearance or Grace Periods: Temporarily reduce or pause payments.

Risks of Restructuring

- Possible impact on your credit score

- Additional fees and legal costs

- More total interest if the term is extended

Traditional vs. Alternative Lenders

Traditional Lenders

- Banks and Credit Unions

- Lower interest rates

- Longer approval process

- Require strong credit and documentation

- SBA Loans

- Government-backed

- Low interest

- Complex application and eligibility requirements

Alternative Lenders

- Online Lenders (e.g., Kabbage, OnDeck, BlueVine)

- Faster approval

- More accessible for low-credit borrowers

- Higher interest rates

- Peer-to-Peer Lending

- Direct funding from investors

- Flexible terms

- Platform fees apply

- Invoice and Merchant Financing

- Suited for businesses with irregular cash flow

- Repayment based on sales or invoices

Exit Strategies and the Role of Loan Terms

Business Loan owners rarely borrow money without envisioning an eventual exit—whether through sale, merger, IPO, or succession planning. Loan terms can significantly impact the feasibility and profitability of those exits.

Selling the Business Loan

- Outstanding Debt Reduces Valuation: Buyers assess liabilities when valuing a business Loan . High-interest or long-term loans can lower your valuation.

- Prepayment Penalties: Some loans penalize early repayment, which could eat into proceeds from a sale.

- Collateral on Critical Assets: If the loan is secured by assets essential to operations (like IP, real estate, or machinery), this may complicate the sale process.

Mergers or Acquisitions

- Loan covenants may restrict mergers without lender approval.

- Due diligence from the acquiring firm will include a full audit of loan terms.

- Suboptimal terms may lead to deal renegotiation or deal-breaks.

Initial Public Offering (IPO)

- High-leverage ratios could make your business Loan look risky to investors.

- Refinancing into more favorable terms pre-IPO can improve your balance sheet and investor perception.

The Impact of Loan Terms on Business Valuation

Whether you’re pitching to investors or preparing for sale, loan terms influence perceived and real value.

Valuation Models Affected by Debt

- Discounted Cash Flow (DCF): Higher loan costs reduce future cash flows, lowering valuation.

- Earnings Multiple (EBITDA): Large monthly repayments reduce earnings, dragging down multiples.

- Book Value Method: Outstanding loan amounts reduce net asset value.

Investor Perception

- Investors may view aggressive debt as a sign of overextension or poor planning—unless it’s clearly tied to ROI-positive growth.

- Clear, flexible loan terms may actually boost confidence in the company’s strategic planning and financial literacy.

Long-Term Growth and Scalability

Loan terms affect not just today’s bottom line but your capacity to grow tomorrow.

Positive Effects

- Favorable terms (low rate, long repayment) can free up capital for R&D, hiring, marketing, or expansion.

- Strategic use of debt can lead to leveraged growth when ROI exceeds interest cost.

Growth Constraints

- High monthly repayments limit reinvestment.

- Restrictive covenants can cap future borrowing or enforce overly conservative financial ratios.

- Personal guarantees may discourage risk-taking and innovation.

Advanced Financial Planning: Using Tools to Evaluate Loan Terms

- Loan Amortization Schedules

- Helps track how much of each payment goes toward principal vs. interest

- Essential for forecasting cash flow and tax deductions

- Sensitivity Analysis

- Simulates changes in interest rates, revenue fluctuations, or repayment schedules

- Helps plan for best-case and worst-case outcomes

- Scenario Planning

- Models different paths: “What happens if revenue drops by 30%?” or “What if we want to refinance after 12 months?”

Real-World Example: Scaling Smartly

Company: “GreenSip Eco Beverages”

- Situation: Looking to expand into 3 new states

- Loan: $750,000 term loan, 8% interest, 5-year term

- Action: CFO negotiated no prepayment penalty and low early-year interest emphasis (front-loading principal)

- Result:

- Positive cash flow within 8 months

- Repaid loan in 3 years

- Exit valuation increased by 20% due to low debt burden

Real-World Cautionary Tale

Company: “Urban Threads Clothing”

- Situation: Took out a merchant cash advance to launch a pop-up chain

- Terms: 48% APR, daily repayments from credit card receipts

- Impact:

- Cash flow drained in 60 days

- Defaulted on payments

- Forced to close 2 of 4 locations

Lesson: Short-term cash relief doesn’t justify long-term financial strain unless returns are fast and certain.

Also Read: What Are the Benefits of a Car Loan Bank for Financing?

Conclusion

The terms of a business loan play a pivotal role in shaping a company’s financial trajectory. While loans can provide the necessary capital for growth and operations, unfavorable terms can strain resources and hinder profitability. It’s imperative for business Loan owners to thoroughly understand loan terms and assess their potential impact on the bottom line before committing.

FAQs

- What is the difference between secured and unsecured business loans?

- Secured loans require collateral, reducing lender risk and often resulting in lower interest rates. Unsecured loans do not require collateral but may have higher interest rates due to increased lender risk.

- How can I negotiate better loan terms?

- Improving your business’s creditworthiness, providing a solid business Loan plan, and demonstrating consistent revenue streams can enhance your negotiating position for better loan terms.

- What are loan covenants, and how do they affect my business Loan ?

- Loan covenants are conditions set by the lender that the borrower must adhere to. They can affect operational decisions and financial strategies, potentially limiting flexibility.

- Can I refinance my business loan to get better terms?

- Yes, refinancing can be an option to secure better terms, such as lower interest rates or extended repayment periods. However, it’s essential to consider associated costs and potential penalties.

- What impact do loan terms have on my business Loan credit score?

- Timely repayment of loans can positively impact your business Loan credit score, while missed payments or defaults can have a detrimental effect.

- Are there government-backed loan programs available?

- Yes, various government-backed loan programs offer favorable terms to support small businesses. Eligibility criteria and terms vary by program and location.

- How do I assess if a loan is right for my business Loan ?

- Evaluate the loan’s interest rate, repayment terms, fees, and any covenants. Consider how these factors align with your business’s financial situation and growth plans.