How Long Is a Home Loan Pre-Approval Good For?

Embarking on the journey to homeownership is an exciting venture, and securing a mortgage pre-approval is often one of the first significant steps. This document not only provides clarity on your borrowing capacity but also positions you as a serious buyer in the eyes of sellers. However, understanding the duration for which this pre-approval remains valid is crucial to ensure a smooth home-buying process.

Key Takeaways

- Pre-Approval Duration: Typically valid for 30 to 90 days, depending on the lender.

- Timely Home Search: Begin your home search promptly to align with the pre-approval period.

- Financial Stability: Maintain consistent financial status to uphold pre-approval validity.

- Renewal Process: If pre-approval expires, contact your lender to discuss renewal options.

Understanding Mortgage Pre-Approval

If you’re planning to buy a home, the term mortgage pre-approval is one you’ll hear often—and for good reason. It’s one of the most important early steps in the home-buying process. Below is a comprehensive breakdown of what mortgage pre-approval is, how it works, why it matters, and how it differs from other similar terms like pre-qualification.

What Is a Mortgage Pre-Approval?

A mortgage pre-approval is a written statement from a lender that tentatively commits to lending you a specific amount of money for a home loan, subject to further conditions (like a property appraisal and final underwriting). It’s based on a thorough review of your financial health and shows real estate agents and sellers that you are a serious buyer.

Think of it as a conditional promise from the lender.

How Is Pre-Approval Different from Pre-Qualification?

| Feature | Pre-Qualification | Pre-Approval |

|---|---|---|

| Based on | Self-reported info | Verified financial data |

| Credit Check | Often not required | Required (hard inquiry) |

| Accuracy | General estimate | Specific loan amount |

| Time to Complete | Quick (minutes to a few hours) | Takes a few days |

| Seller Confidence | Lower | Higher |

Summary: Pre-qualification is a casual first step, while pre-approval is a formal commitment (not final approval) that you’re qualified to borrow up to a certain amount.

What Documents Are Needed for Pre-Approval?

Lenders will request the following documents to determine your borrowing ability:

- Proof of Identity

- Government-issued ID (e.g., driver’s license or passport)

- Proof of Income

- Recent pay stubs (last 2–3 months)

- W-2 forms (last 2 years)

- Tax returns (last 2 years)

- Proof of additional income (bonuses, alimony, etc.)

- Proof of Employment

- Employer contact details

- Letter of employment or verification

- Proof of Assets

- Bank statements (checking, savings, investment accounts)

- Retirement account balances

- Gift letters (if funds are gifted for down payment)

- Credit History

- Lender will run a credit report (hard pull)

- Debt Information

- Auto loans, student loans, credit card balances, etc.

What Do Lenders Look at During Pre-Approval?

Lenders perform a comprehensive financial analysis, usually focused on:

- Credit Score

A score of 620 or higher is generally required for most conventional loans. FHA loans may allow scores as low as 580. - Debt-to-Income Ratio (DTI)

This measures how much of your income goes toward paying debts. Most lenders prefer a DTI of 36% or less. - Income Stability

Consistent income for the past 2 years is a big plus. - Down Payment Availability

Lenders want to see you have funds for the down payment and closing costs. - Employment History

Stability and reliability in employment are considered favorable.

How Long Does Pre-Approval Take?

- Time to Apply: 1–2 hours to gather and submit documents

- Lender Review Time: 1 to 3 business days

- Letter Validity: Typically 60 to 90 days

Some online lenders offer same-day pre-approval, but most take a couple of days to complete the full review.

What’s Included in a Pre-Approval Letter?

A standard pre-approval letter includes:

- Borrower’s name

- Estimated loan amount

- Loan type (conventional, FHA, VA, etc.)

- Interest rate (estimate)

- Down payment amount

- Lender contact info

- Expiration date

This letter is used when making offers on homes—it shows sellers you have the financial backing to follow through.

Important Notes & Limitations

- Not a Guarantee: Pre-approval is not the same as full mortgage approval. Final approval happens after you find a home, it’s appraised, and the loan goes through underwriting.

- Hard Inquiry: The credit check will result in a hard inquiry, which may temporarily lower your credit score.

- Expires in 60–90 Days: If you don’t buy a home within this period, you’ll need to renew .

Tips for a Strong Pre-Approval

Stay in contact with your lender

Check your credit report beforehand

Avoid major purchases (like cars or furniture) during the process

Don’t change jobs mid-way through unless necessary

Keep financial documents updated and ready

Typical Duration of a Pre-Approval

Understanding how long a mortgage pre-approval lasts is critical for timing your home-buying journey. A mortgage pre-approval is not indefinite—it comes with an expiration date, and if it lapses, you may need to start the process again. Let’s break this down to understand how long pre-approval is valid, what affects its duration, and how to renew it if needed.

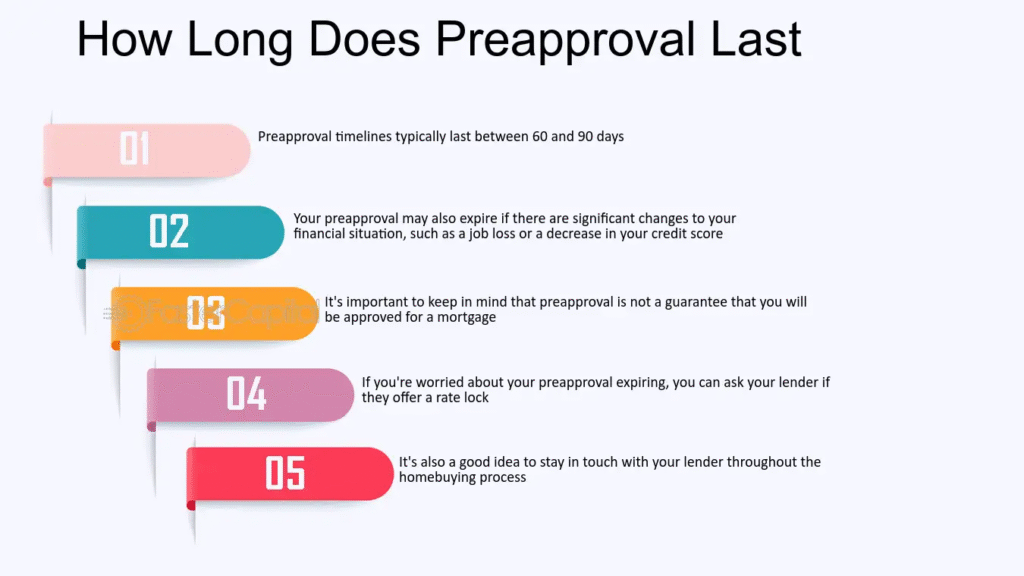

How Long Does a Mortgage Pre-Approval Last?

Most mortgage pre-approvals are valid for:

- 60 to 90 days (about 2 to 3 months)

Some lenders may issue shorter or longer timeframes depending on the borrower’s situation and internal lending policies.

Why Is There an Expiration Date?

Lenders set a validity period for approvals because your financial profile can change quickly, which may impact your ability to repay a loan. A pre-approval is based on the financial data available at the time of application, such as:

- Credit score

- Income level

- Employment status

- Debt load

- Available assets

If any of these change—even slightly—it can affect the loan amount or terms you qualify for. The expiration date allows lenders to reassess your profile and reduce their risk exposure.

What Can Cause a Pre-Approval to Expire Sooner?

Even if your letter says 90 days, certain changes in your financial situation can lead to an early expiration or re-evaluation. These include:

- Taking on New Debt (e.g., car loan, large credit card balance)

- Job Loss or Career Change

- Major Withdrawals from Savings

- Significant Credit Score Drop

- Rising Interest Rates

Any of these changes could prompt your lender to require a new financial review before proceeding with your mortgage application.

How to Renew or Extend a Pre-Approval

If you’re nearing the expiration date and haven’t found a home yet, you can renew your approval. Here’s how:

Steps to Renew Your Pre-Approval:

- Contact Your Lender:

Let them know you want to extend your approval. - Submit Updated Documents:

You’ll likely need to provide:- Updated pay stubs

- New bank statements

- Any changes in employment or assets

- Credit Check (Again):

The lender may perform another hard inquiry to ensure your credit profile hasn’t changed. - Receive New Pre-Approval Letter:

If all is in order, the lender will issue a new letter with a new expiration date.

Why Acting Within the Validity Period Matters

- Saves Time: Renewing approval can be quicker than reapplying from scratch, but acting fast avoids extra steps.

- Maintains Seller Trust: A valid, recent approval letter strengthens your offer in a competitive market.

- Protects Against Rate Fluctuations: Interest rates can change quickly. A delayed process may mean qualifying for a higher rate later.

Tips to Maximize the Use of Your Pre-Approval Window

Once you’ve been pre-approved for a mortgage, you’re in a great position to start looking for a home. However, a mortgage pre-approval is not indefinite and generally lasts for only 60 to 90 days. To make the most of that window, it’s essential to stay organized, act quickly, and make smart financial decisions during this period. Below are some key strategies to help you maximize your pre-approval window:

Stay Within Your Budget

Why It Matters:

Pre-approval provides you with a specific loan amount that you can borrow based on your financial situation. It’s easy to get excited and start looking at homes that are just slightly outside your approved range, but this can cause problems later.

How to Maximize It:

- Stick to your budget: While you may be pre-approved for a larger loan, it’s a good idea to stay within a budget that aligns with your long-term financial goals.

- Consider your comfort level with monthly payments: Just because you are approved for a certain amount doesn’t mean you should push your financial limits.

- Look at homes below your maximum pre-approval: This gives you some flexibility if any financial changes occur, such as interest rates rising or unforeseen expenses popping up.

Example:

If your pre-approval allows you to borrow up to $500,000, but you’ve calculated that you’re comfortable with a monthly payment around $2,000, you might choose homes priced around $450,000–$475,000 instead.

Act Quickly in a Competitive Market

Why It Matters:

In hot real estate markets, homes can sell quickly. With a limited approval window, acting fast ensures you don’t miss out on a property you like.

How to Maximize It:

- Don’t wait too long to start looking: As soon as you’re pre-approved, begin browsing listings, attending open houses, and scheduling showings with a real estate agent.

- Make offers as soon as possible: If you find a home that fits your criteria, don’t hesitate to make an offer, especially in competitive markets where homes are often sold after just a few days.

- Work with a knowledgeable agent: A good real estate agent will be able to help you find homes quickly and guide you through the offer process with urgency.

Example:

If you’re actively house hunting, having a real estate agent ready to submit an offer within 24 hours can increase your chances of locking in the property before someone else does.

Avoid Major Financial Changes During the Pre-Approval Period

Why It Matters:

Your approval is based on your financial situation at the time it’s granted. Major financial changes, like taking on new debt or making large purchases, can impact your credit score, debt-to-income (DTI) ratio, and overall loan eligibility.

How to Maximize It:

- Avoid taking on new debt: Refrain from opening new credit cards, making large purchases (e.g., car loans, furniture), or taking out additional loans during the approval period.

- Don’t quit your job or change careers: Job stability is a key factor in the lender’s decision to approve your loan. Changing jobs or taking a pay cut can raise red flags for lenders.

- Refrain from large financial transactions: Even if you have enough savings for a down payment, avoid making significant withdrawals or transfers from your accounts, as this can raise concerns about your financial stability.

Example:

If you decide to buy a new car after being pre-approved for your mortgage, your DTI ratio might go up, which could cause the lender to reassess your loan eligibility. This can lead to a delay or a lower loan amount.

Regularly Check Your Credit Report

Why It Matters:

Your credit score is one of the most important factors affecting your mortgage approval. If your credit score drops, it could impact the final loan offer you receive or even cause your loan to be declined.

How to Maximize It:

- Monitor your credit: Regularly check your credit report for errors, and dispute any inaccuracies that could harm your credit score.

- Avoid new credit inquiries: Each time a lender checks your credit, it results in a “hard inquiry” that could temporarily lower your score. Try to limit hard inquiries during this time.

- Pay bills on time: Ensuring all your bills are paid on time during the pre-approval window will help keep your credit score high.

Example:

If you notice an incorrect late payment listed on your credit report during the pre-approval period, disputing it and having it removed before your closing can help maintain or even improve your credit score.

Stay in Touch with Your Lender

Why It Matters:

Your pre-approval is a conditional offer, and the lender may need updated documents to ensure everything stays on track. Maintaining communication with your lender ensures there are no surprises when you’re ready to close.

How to Maximize It:

- Keep your lender updated: If there are any changes in your employment, income, or financial status, inform your lender immediately.

- Ask about any changes in lending rates or conditions: Rates or loan terms could change during your search, and staying in touch with your lender will help you adapt quickly.

- Confirm documentation needs: If additional documents or updated information are required, provide them as soon as possible to avoid delays.

Example:

If your lender asks for updated pay stubs after a few weeks, promptly submitting the requested information can keep your pre-approval valid and prevent delays when you make an offer on a home.

Don’t Make Any Major Purchases

Why It Matters:

Major purchases can temporarily reduce your available credit and increase your DTI ratio, which may result in a lower loan amount or cause your lender to revoke the pre-approval.

How to Maximize It:

- Delay large purchases: Wait until after you’ve closed on your home before making major purchases, like buying a car or taking out new loans.

- Focus on saving: Rather than spending on non-essentials, put as much as possible into your savings for a larger down payment or closing costs.

Example:

If you buy a new vehicle or take out a large loan after being pre-approved for a mortgage, this could increase your debt load, which might reduce your pre-approval amount or delay the process entirely.

Use a Mortgage Rate Lock if Available

Why It Matters:

Interest rates fluctuate. If rates go up during your pre-approval period, you may end up with higher monthly payments than you initially anticipated. A mortgage rate lock guarantees your interest rate for a set period.

How to Maximize It:

- Lock your rate: Once you’re certain that you’re moving forward with a property, consider locking in your mortgage rate with the lender to protect against potential rate hikes.

- Ask your lender about their rate lock policies: Different lenders have different policies, so it’s important to understand how long a rate lock will last and any associated costs.

Example:

If you’re pre-approved and ready to move forward with a home, but rates are expected to rise soon, locking in a rate now can save you money in the long term, ensuring you get the best deal possible.

Consider Your Pre-Approval Expiration Date and Plan Ahead

Why It Matters:

Your pre-approval is time-sensitive, so understanding when it expires can help you plan your next steps effectively.

How to Maximize It:

- Start house hunting immediately: Don’t wait too long to begin viewing homes or making offers. Get the most out of your approval window by acting early.

- Plan to renew the pre-approval if necessary: If you are nearing the expiration date without having secured a home, contact your lender to discuss renewing the approval or starting the process again with updated information.

Importance of Timely Home Search

Given the limited validity of pre-approvals, it’s advisable to commence your home search promptly after obtaining one. This approach ensures that you can make offers within the approval’s timeframe, enhancing your credibility with sellers. Delaying the search may result in the expiration of your pre-approval, requiring you to reapply and potentially face changes in loan terms.

Steps to Take if Pre-Approval Expires

If your pre-approval expires before you’ve secured a home, consider the following steps:

- Contact Your Lender: Reach out to discuss the possibility of renewing or extending your approval.

- Provide Updated Documentation: Be prepared to submit recent financial documents to reflect your current situation.

- Reassess Your Financial Status: Ensure that there have been no significant changes in your income, debts, or credit score.

Renewing your approval can expedite the process of obtaining a mortgage once you find a suitable property.

Typical Duration of a Mortgage Pre-Approval

A mortgage pre-approval is a critical step in the home-buying process, providing you with a clear understanding of how much you can borrow. However, it’s essential to note that approvals are not indefinite. The validity period can vary based on several factors:

Standard Validity Period

- 60 to 90 days: This is the most common duration for mortgage approvals. Lenders typically set this timeframe to ensure that your financial situation remains stable and that the information used to assess your eligibility is current.

- 30 to 60 days: Some lenders may issue pre-approvals with shorter validity periods, especially if market conditions are volatile or if they require more frequent updates to your financial information.

Factors Influencing Validity Period

Several factors can influence the duration of your pre-approval:

- Lender Policies: Different lenders have varying policies regarding the validity of pre-approvals. It’s crucial to inquire about the specific duration when you receive your approval letter.

- Market Conditions: In times of economic uncertainty or fluctuating interest rates, lenders may shorten the validity period to mitigate risk.

- Changes in Your Financial Situation: Significant changes in your income, employment status, or credit score can affect the validity of your pre-approval. Lenders may require updated documentation if such changes occur.

What Happens When a Pre-Approval Expires?

If your pre-approval expires before you find a suitable property, you have the option to renew it. Here’s what the process typically involves:

- Contact Your Lender: Reach out to your lender to express your intent to renew the pre-approval.

- Provide Updated Documentation: Submit recent pay stubs, bank statements, and any other required financial documents to reflect your current financial situation.

- Undergo a New Credit Check: Be prepared for a new credit inquiry, as lenders need to ensure your creditworthiness hasn’t changed.

- Receive a New Pre-Approval Letter: If your financial situation remains stable, your lender will issue a new approval letter with an updated expiration date.

Tips to Maximize the Validity of Your Pre-Approval

To ensure your pre-approval remains valid and to avoid potential delays:

- Maintain Financial Stability: Avoid making significant purchases or taking on new debt during the pre-approval period.

- Monitor Your Credit: Regularly check your credit report for any discrepancies or issues that could affect your credit score.

- Communicate with Your Lender: Keep your lender informed of any changes in your financial situation to prevent surprises during the home-buying process.

Impact of Financial Changes on Pre-Approval

Any significant alterations in your financial circumstances can affect the validity of your approval. Such changes may include:

- Job Loss or Income Reduction: A decrease in income can impact your debt-to-income ratio.

- Increase in Debt: Taking on additional loans or credit can affect your creditworthiness.

- Large Unexplained Deposits: Deposits that cannot be traced may raise concerns during underwriting.

It’s crucial to maintain financial stability during the home-buying process to ensure the continued validity of your approval.

Strategies to Maintain Pre-Approval Validity

To maximize the duration and effectiveness of your pre-approval:

- Avoid Major Financial Changes: Refrain from making significant purchases or opening new credit lines.

- Monitor Credit Reports: Regularly check your credit reports for errors or discrepancies.

- Maintain Savings: Ensure that your savings remain intact to cover down payments and closing costs.

By adhering to these practices, you can help ensure that your approval remains valid throughout your home search

Also Read: What Are the Benefits of a Car Loan Bank for Financing?

Conclusion

Understanding the duration and conditions of your mortgage approval is vital in navigating the home-buying process. By staying informed and proactive, you can ensure that your approval remains valid and that you are well-positioned to secure your desired property.

By adhering to these guidelines, you can navigate the home-buying process with confidence and clarity.

FAQs

1. Can I extend my mortgage pre-approval?

Yes, many lenders offer extensions or renewals of approvals, provided there have been no significant changes in your financial situation.

2. Does a pre-approval guarantee loan approval?

No, pre-approval indicates that you are likely to qualify for a loan based on your current financial status, but final approval depends on further underwriting and the property appraisal.

3. Will my credit score be affected by a pre-approval?

Yes, obtaining a pre-approval involves a hard inquiry on your credit report, which may cause a slight, temporary dip in your credit score.

4. How can I check the expiration date of my pre-approval?

The expiration date is typically specified in the pre-approval letter provided by your lender.

5. What happens if I don’t use my pre-approval before it expires?

If your pre-approval expires, you may need to reapply and provide updated financial documentation for reassessment.

6. Can I apply for pre-approval with multiple lenders?

Yes, you can apply with multiple lenders, but it’s advisable to do so within a short timeframe to